We understand the fundamental retirement process – investing funds and witnessing growth with the hope of a secure financial future. But how does that growth actually occur and how does compound interest play a pivotal role in retirement funds?

According to a recent study, Americans find financial health goals to be more important than physical or mental health goals. With this in mind, let’s answer the question, “what is compound interest?” and touch on how it can help your family reach their financial goals.

What is Compound Interest?

With an increased focus on financial health in America, it is important to understand the details of investing. So, what is compound interest and how does it work? Compound interest describes the interest earned from prior interest. It accelerates your investment growth year over year as your investments earn more interest. Compound interest is one of the main factors contributing to substantial growth in traditional investment vehicles like a 401(k), IRA, mutual fund and more.

Let’s explore this example together. Assume you have $2,000 in an investment account that earns 8% interest annually. In a year, you would earn $160, earning a balance of $2,160. By the next year, you would earn 8% on the increased balance of $2,160, which is $172.80. This creates an even larger balance of $2,332.80. Repeating this pattern creates predictable and escalated growth.

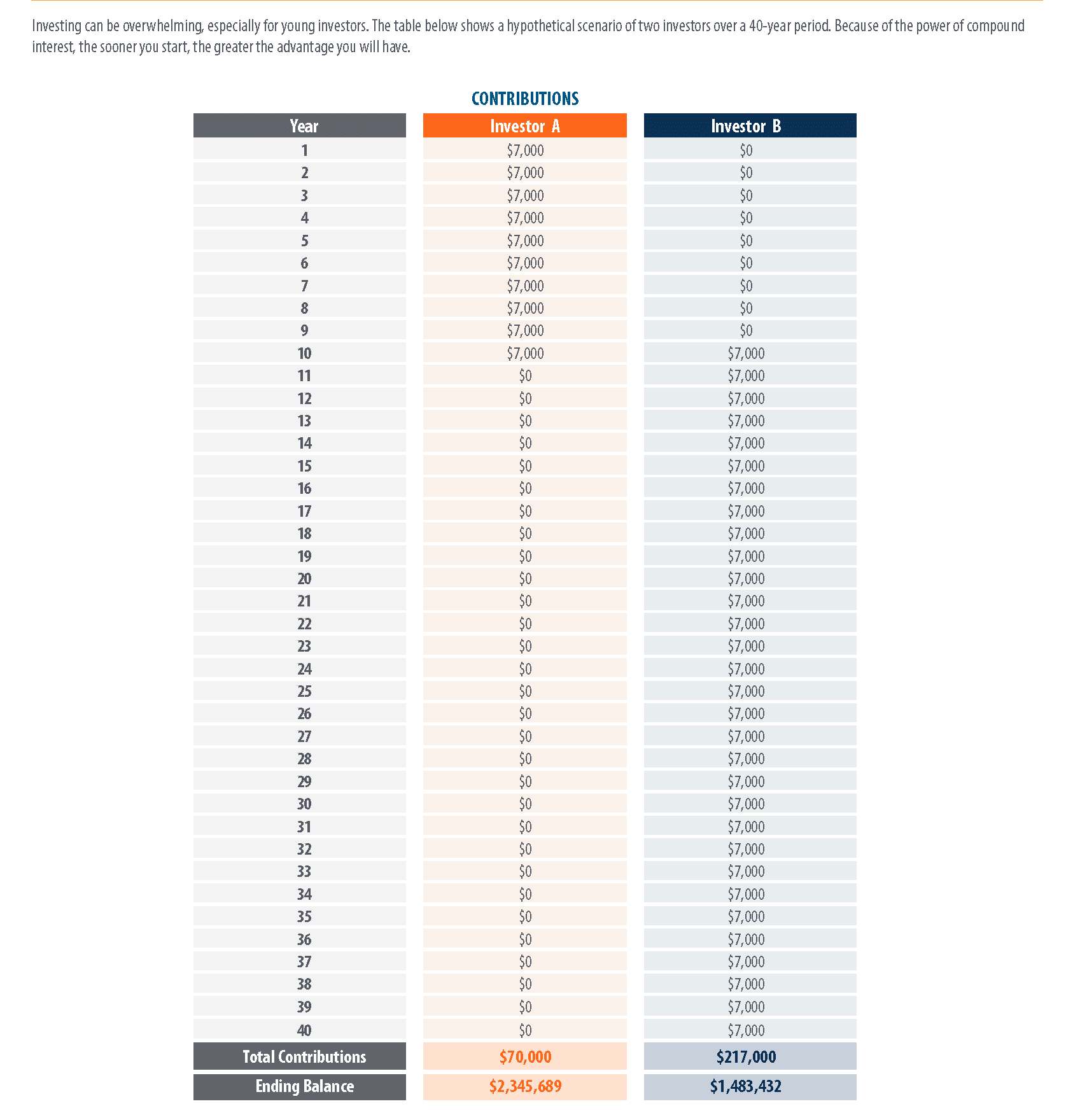

This additional example is from First Trust. They demonstrate the power of compound interest by giving a hypothetical scenario of two investors. One investor begins early and invests for the first 10 years of their career. The second investor waits 10 years to begin their investment journey, resulting in more required funds for a reduced final amount. The early investor contributed $70,000 and ended up with $2,345,689 compared to the second investor who contributed $217,000 and ended with $1,483,432.

Why it Matters

The concept of investing can be overwhelming and easily deprioritized, especially in times of economic uncertainty or inflation. But the math of compound interest doesn’t lie. Investing earlier always facilitates a greater advantage. Now that we understand the importance of compound interest, how can you prioritize investing in 2024?

Finding additional funds to invest this year isn’t an easy task. Consider taking a step back and reevaluating your budget, setting up automated investing or implementing micro-financial goals to get the ball rolling.

One of the most significant benefits of compound interest is the concept of protection from wealth erosion. Wealth erosion refers to the decline of wealth due to inflation, increased living expenses and other factors. In today’s current economic environment, protection from these erosion factors is fundamentally more important.

That said, beginning to invest later is always better than never investing at all. The sooner you start, the sooner your interest will compound and grow for a prosperous financial future.

Bankers Life is Here

Bankers Life is here to help you reach your financial goals. Whether you are new to investing or are a seasoned pro, connect with a Bankers Life representative to learn more about additional ways to maximize your financial security.